FINANCE

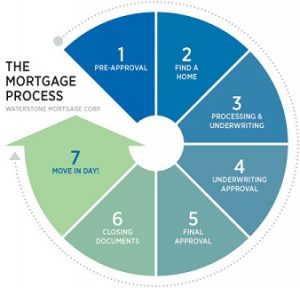

The mortgage process involves several steps from the initial application to the closing of the loan. Here’s a comprehensive guide to help you understand each stage:

1. Assess Your Financial Situation:

- Review your credit score, income, and debt to determine how much mortgage you can afford. This step helps set realistic expectations for your homebuying process.

2. Pre-Approval:

- Get pre-approved for a mortgage by submitting financial documents to a lender. Pre-approval provides an estimate of the loan amount you qualify for, making your home search more focused.

3. Identify Your Budget:

- Consider additional costs such as property taxes, homeowner’s insurance, and maintenance. Your budget should not only cover the mortgage payment but also these associated expenses.

4. Find a Mortgage Lender:

- Research and compare mortgage lenders. Consider factors such as interest rates, loan terms, and customer service. You may choose a bank, credit union, or mortgage broker.

5. Choose a Mortgage Type:

- Select the type of mortgage that suits your needs. Common options include fixed-rate mortgages (with a constant interest rate) and adjustable-rate mortgages (with rates that may change over time).

6. Submit the Mortgage Application:

- Complete a mortgage application, providing detailed information about your finances, employment, and the property you intend to purchase. The lender will use this information to assess your eligibility.

7. Loan Processing:

- The lender reviews your application, verifies your information, and orders a home appraisal to determine the property’s value. They may also request additional documentation during this stage.

8. Underwriting:

- Underwriters assess the risk associated with your loan. They examine your creditworthiness, employment history, and financial stability. The underwriting process ensures that the loan complies with lending guidelines.

9. Conditional Approval:

- After underwriting, you may receive a conditional approval, specifying any additional requirements or conditions that must be met before final approval and closing.

10. Rate Lock:

- If you haven’t already, consider locking in your interest rate to secure the current market rate. This prevents rate fluctuations before closing.

11. Closing Disclosure:

- Receive a Closing Disclosure, a document outlining the final loan terms, closing costs, and other financial details. Review it carefully and ensure its accuracy.

12. Final Loan Approval:

- Once all conditions are met, the loan receives final approval. This stage often involves coordinating with the title company, insurance provider, and other relevant parties.

13. Closing:

- Attend the closing meeting, where you’ll sign the necessary documents to finalize the mortgage. Bring identification, proof of insurance, and any funds required for closing costs.

14. Funding:

- The lender funds the loan, transferring the funds to the seller or their representative. This step completes the purchase transaction.

15. Move In:

- Once the closing process is complete, you can take possession of your new home and begin making mortgage payments according to the agreed-upon terms.

Understanding each step of the mortgage process can help you navigate the homebuying journey with confidence. It’s essential to communicate effectively with your lender and stay informed throughout the process.